Visual QR Codes (TM)

Enhance your Digital Presence – Connect Customers with your Brand!

Brands recognize the need to connect Offline and Online

99% of the Offline advertisements include an Online Call to Action!

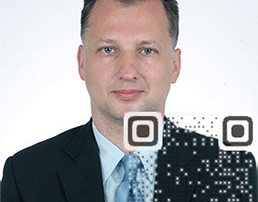

Visualead technology turns ANY image into a Visual QR Code (TM)!

DNN Direct is an authorized seller of Visual QR Code (TM) Technology in South East Asia. DNN Direct is an expert at Mobile Marketing creating better interactions between people and brands through mobile innovation. Visualead mobile cutting edge technologies is a patent-pending Visual QR Code (TM) technology and mobile marketing O2O platform. This technology helps businesses connect with their customers both Offline and Online through a fun and effective mobile experience. Visualead can easily embed QR codes into any image or advertisement, blending the familiar QR codes that people know with the visual call-to-action that people love, increasing customer interaction and engagement with brands. We present to you the perfect platform to create Visual QR Codes (TM) and mobile campaigns.

Please contact us for more information.

Note: Visual QR Code is registered trademark of Visualead.

VQR Code Examples

Please Click on image to scan

Animations

Mc Donalds

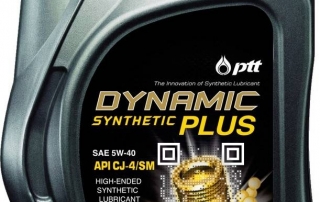

PTT

DTAC, Lazada, Krungsri, K-Bank

De’Siam, Health Genesis, Refreshco, Unique

PaysBuy

Vee Rubber

FamilyMart

APCD

Greetings

Another QR code examples

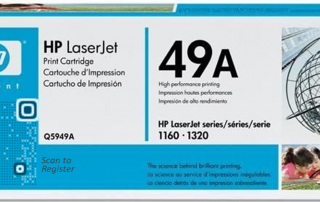

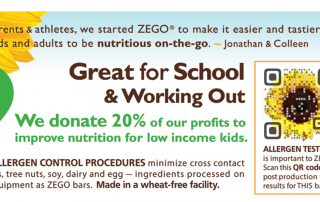

Packaging samples

Introduction Video

Samples of Visual QR Codes (TM) on the Video

Payments by VQR

Introduction

The QR code was invented and patented (yes, patented) by Denso Wave, a division of Toyota. It was designed for the automotive industry, but the patent was not enforced in order to allow widespread acceptance. QR codes are no longer a novelty in Japan, and their use is widespread.

Quick Response (QR) Codes are two-dimensional bar codes that, like RFID labels, have greater storage capacity than bar codes with the additional benefit of being less costly to produce than the electromagnetic labels. Not only can QR Codes enable mobile point of sale purchases, they can transmit detailed product information by simply scanning them to a consumer’s smart phone.

The codes were originally invented in 1994 by Denso-Wave, a subsidiary of Toyota, to track vehicle parts during the manufacturing process. Prior to their use in retail, QR codes began to be engraved on Japanese tombstones in 2008, supplying visitors with detailed information on the deceased and to and track the number of visitors. Three years later, the first commemorative coin containing a QR code was issued by the Royal Dutch Mint to provide background on its 100- year history.

QR codes are now appearing in increasing numbers on product packaging, a number of forms of media including billboards and magazine and TV advertising, along with previously unheard of locations such as bus stop, train and subway station kiosks, enabling consumers to make on the fly purchases, receive background information on products and services or simply to drive website traffic.

Banking and Remittance uses of QR codes

1. Withdraw Cash through ATM: One feature of QR codes is being implemented by financial services giant FIS – allowing users to withdraw cash from an ATM with their smartphones by scanning a QR code on the ATM screen.

2. Processing Payments: Paydiant’s mobile payment technology lets their clients scan a QR code with the phone’s camera to process payment. Their technology supports any existing cell phone cameras and merchants do not need to upgrade any equipment to use Paydiant.

3. Paying for in-store purchases: PayPal recently unveiled a new ‘Payment Code Technology’ that allows customers to make in store payments using a QR code generated by an app on a customer’s smartphone Here’s how it works:

3.1 When the customer is at the merchant’s location ready to be checked out, he opens the PayPal app on the smartphone.

3.2 The app prompts the customer with a QR code, or a 4 digit short code.

3.3 The merchant either scans the QR code or the customer enters the 4 digit number into existing card swiping terminal, to complete the purchase.

4. Mobile Banking Application – Comarch offers a mobile banking application as part of the Comarch Smart Finance solution. Mobile Wallet ‒ mobile payments and micro-loans based on QR codes and NFC. smartfinance.comarch.com

5. Education for entrepreneurs to start their own business in India – Once a participant in training will qualify, she will receive a certificate with a QR code on it, allowing her to obtain a micro-loan from a participating bank to start her business. krannert.purdue.edu

6. Raise awareness – Samuel Adams leverages QR codes to raise awareness of SMB microloan program. Samuel Adams is placing QR codes on posters in bars to support a microloan program for small business owners by making it easy for mobile users to find out more about the initiative. mobilemarketer.com

7. Accept Bitcoin payments at offline cash register – Display a QR-code with your Bitcoin address next to your cash register.

http://earn-bitcoins.com/

8. Expedited RSVP & Lead Generation for micro loan applicants

Geico leverages QR codes on direct mail prospecting pieces to generate leads. It also presents a unique opportunity to calculate “open rates” for direct mail.

Business goal: Lead generation and sign-up

Conversion challenge: Increase the # of sign-ups

Industry: Retail, professional services, professional association

Feature QR codes on promotional materials that encourage users to scan and sign-up. The “sign-up” logic could work for entering contests, joining professional associations/LinkedIn groups, registering for events, or RSVP’ing to invites. If you’re linking to a lead form, be sure to auto-fill information (if applicable) to save the user time.

“When” opportunities: Upon receipt of a postal mail letter/invitation, tradeshow/expo booth visit

Barcode content: Link to an online sign-up form

Tip: The USPS is offering a 3% discount on summer business mailers that include a mobile barcode. bit.ly/USPSqrcodepromo

Alternative option: Link the QR code to a video that highlights sign-up benefits or “greatest moments” and close the video with a call-to-action link that takes users to the online lead form.

6. Digital version of your magazine with QR Codes – www.psfk.com

7. Download your mobile banking application – please see example we did for Krungsri Bank below. After scanning our system will detect which app store platform to visit (Android Google Play or iOS App store).

Other Uses for Marketing and Promotion

QR codes have come a long way from inventory and quality checks at automakers. QR codes have found a great use in the marketing industry. Some ways in which QR codes have been adopted by various companies include:

1. Games for promotion: Pirates, buried fortunes, ancient maps and lost jewels usually come to mind when someone says “Treasure Hunt”. Taking an out of the box approach, MoLo Rewards in combination with Association of Town and City Management (ATCM) had set up a treasure hunt for a group of top retailers in UK between 21st and 29th of September 2013. www.youtube.com

2. Shopping online through platforms like Twitter: BuyReply is an Australian-based transactional advertising platform. Which allows consumers to buy directly from any offline medium including television, radio, print & web without requiring to download an app. BuyReply also enables customers to buy via Twitter and QR code scans. The customer emails “laptop” to [email protected] or Tweets “@shopharveynorman laptop” to buy a laptop. You can read more on BuyReply’s scan to buy feature, here.

3. Rewards and Bill pay at Restaurants: RewardLoop, a mobile loyalty startup, designed a loyalty program. The program rewarded customers based on spend per transaction through tapping into data from Prestons existing POS system. A POS adaptor which is a hardware device was installed between the POS system and the receipt printer to “listen in” on the data stream. The adaptor reads each line of the receipt and uses the sum of the total bill to insert a unique QR Code into the bill’s footer which customers scan to collect and redeem rewards set by Prestons.

4. Shop through smartphone: Another company that claims to create QR code magic is Ensygnia. Their Onescan app which is a SaaS platform, allows users to make payments by scanning a QR code with a mobile application. Bank details need to be provided only once and not every time a transaction is made through credit or debit cards. Additionally, there is no need for user names and passwords to process a payment.

5. Customer Loyalty Rewards: Front Flip a Kansas based company uses QR codes to reward loyal customers.Front Flip’s clients (mostly restaurants) offer their customers a unique QR code. Front Flip’s QR codes can be found on a restaurant’s table and on the back of the receipts. Customers enter their personal details through the Front Flip app to access the code. Customers scan the code through a Front Flip app on a smartphone to receive a digital scratch card. Prize or promotion details are revealed and the users can share their prize details with their friends on Facebook and Twitter. Another example is that of Andreessen Horowitz backed Belly which seeks to reinvent customer loyalty rewards through gamification and digital check-ins. To check in, customers can scan the belly card (QR code) or use belly smartphone app at an in-store iPad POS and with each check-in they accumulate reward points that can later be redeemed for unique rewards tailored specifically for the business in question.

QR codes are gaining wide acceptance, especially in USA. Thanks to companies who plan to integrate marketing, loyalty and payments. Usage of QR codes across the commerce processes is a good sign.

Ease of use could also be one of the drivers which is helping gain QR codes wide acceptance. Availability on most of the mobile devices is another great advantage. Looking at the statistics, the adoption rate of QR codes for payments in USA seems to be faster than other enabling tech, with an average of 19% of the respondents (1 out of 5) having scanned a QR code, according to eMarket survey.

QR Payment Case Studies

There are two companies in Singapore and USA doing payments by QR Codes very successfully:

1) www.paydiant.com

2) www.thelevelup.com

QR Pay

QR Pay offers a mobile payment processing solution that enables individuals and businesses to make and receive payments with QR Codes via the QR Pal or QR Pay smart phone applications. QR Pay also offers payments by SMS/Text opening up the service to all mobile phone users. www.qrpay.com

QR Pal

QR Pal is a Smart Phone Application which enables users to Scan, Store and Share their QR Code and Barcode scans. QR Pal includes QR Pay’s new contactless payment solution that enables individuals and businesses to make payments via QR Codes and mobile phones. Other features include SafeScan (protecting users from malicious codes), product comparison (barcodes), online backups and synchronisation.

PayPal

The company announced that it is introducing Payment Code, a new technology intended to enable shoppers to make purchases by scanning a QR code on their mobile phone, or receive a short four-digit code on their phone, to complete a purchase.

According to the PayPal blog, Payment Code is an extension of the company’s offerings aimed at enhancing in-store payments. “Our approach isn’t to push technology for technology’s sake, but to truly make the paying experience better for consumers and to give merchants more opportunity to innovate without a costly investment,” PayPal Vice President of Retail Services Don Kingsborough wrote. “Payment code is easy to use and understand and utilizes a ubiquitous technology that merchants have and are familiar with.

When shoppers are ready to pay, they open the PayPal app (or the specific merchant’s app) and check in at that location, which will result in the app prompting them with a QR code, or a four-digit short code, to authenticate their purchase.

If the merchant has a barcode or QR code scanner, the merchant scans to complete the transaction. If the merchant doesn’t, then a four-digit code pops up on the shopper’s phone that can be entered into the PIN pad at checkout.

PayPal Beacon allows merchants to make check in seamless and automatic for consumers by letting them just pay with an image of their face that appears on a merchant’s POS screen. But what if the merchant POS system doesn’t have a screen that can display images? That’s why today we’re introducing Payment Code. No need to rip & replace hardware at the point of sale to take advantage of leading edge technologies to make payments easy and drive consumer engagement.

This new technology lets consumers make purchases by scanning a QR code on their mobile phone, or receive a short four-digit code on their phone to complete a purchase. Payment code is an extension of our offerings for enhancing the payments experience in-store. Our approach isn’t to push technology for technology’s sake, but to truly make the paying experience better for consumers and to give merchants more opportunity to innovate without a costly investment. Payment code is easy to use and understand and utilizes a ubiquitous technology that merchants have and are familiar with.

How does it work?

When you’re ready to pay, simply open the PayPal app (or the specific merchant’s app.) and check in. Once you’re checked-in at that location, the app prompts you with a QR code, or a four-digit short code, to authenticate your purchase. If the merchant has a barcode or QR code scanner, the merchant scans and, just like that, you have paid. If the merchant doesn’t then a four-digit code pops up on your phone, you (or the merchant) simply punch that code into the PIN pad at checkout. Boom, done!

What is the benefit to the consumer?

As we have said many times before, the problem that needs to be solved is not paying at a POS terminal. While payment code does make the checkout process smooth, with easy access to all funding sources in one simple place (your phone), the real benefit is that it will allow consumers to automatically redeem any special offers, gift cards, merchant rewards programs or other forms of payment that might be saved in their PayPal wallet in one quick transaction.

What is the merchant benefit?

Our philosophy at PayPal is to make digital payments as easy as possible for both consumers and merchants. Many of the merchants we have talked to – and trust us we have talked to a lot – want to get the benefits of these new ways to pay but they don’t want to rip out their existing technology to do it.

Payment code lets them take advantage of mobile payments using their old technology. Utilizing the millions of 2D barcode scanners already sitting on store counters and 40+ million payment terminals available around the world, this offers an easy way to give customers the benefits without investing in new technology.

But what if the merchant already has a mobile app for their customers?

Those merchants with a mobile app and older systems can still use payment code by integrating it into their own mobile app. The PayPal QR code will then appear as within the merchant’s own app.

We expect to roll out payment code globally in the first quarter of 2014, and look forward to sharing more at that time. This is just another way that we are driving new technologies and tools to help consumers and merchants of all sizes take advantage of the rising wave of digital payments.